Unveiling the Secrets: Powerful Ways to Maximize Your Income Tax Potential

4.9 out of 5

| Language | : | English |

| File size | : | 365 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 95 pages |

| Lending | : | Enabled |

Are you tired of overpaying on your income taxes? Do you wish there was a way to legally minimize your tax liability and increase your savings? Look no further than the groundbreaking book, "Powerful Ways To Maximize Your Income Tax Potential."

Authored by a team of experienced tax professionals, this comprehensive guide provides a wealth of practical strategies and invaluable insights to help you optimize your tax returns and maximize your financial well-being.

Section 1: Understanding the Tax Code

The first section of the book lays a solid foundation for understanding the complexities of the tax code. It explains the different types of income, deductions, and credits, empowering you with the knowledge to navigate the tax system effectively.

By understanding the rules and regulations, you'll be able to spot potential tax savings opportunities and avoid costly mistakes.

Section 2: Maximizing Deductions

This section delves into the world of deductions, exploring the various ways to reduce your taxable income. From itemized deductions to standard deductions, you'll discover how to identify and maximize eligible expenses, such as mortgage interest, charitable contributions, and medical expenses.

By optimizing your deductions, you can significantly lower your tax bill and boost your savings.

Section 3: Utilizing Tax Credits

Tax credits play a crucial role in reducing your tax liability. They are dollar-for-dollar reductions that are applied directly against your tax bill. This section provides a comprehensive overview of the different types of tax credits available, including the Earned Income Tax Credit, the Child Tax Credit, and the Saver's Credit.

By claiming all eligible tax credits, you can further minimize your tax burden and increase your financial resources.

Section 4: Tax-Saving Strategies for Individuals

Tailored specifically for individuals, this section offers a range of tax-saving strategies to help you optimize your tax returns. From retirement planning to education expenses, you'll learn how to take advantage of various tax breaks and deductions to reduce your tax liability.

Whether you're a single taxpayer or a family with children, you'll find valuable insights to maximize your income tax potential.

Section 5: Tax-Saving Strategies for Businesses

Businesses of all sizes can benefit from sound tax planning. This section provides comprehensive guidance on optimizing tax strategies for corporations, small businesses, and the self-employed. You'll learn about business expenses, depreciation, and other deductions that can minimize your tax liability and boost your company's profitability.

By implementing the strategies outlined in this section, you can create a tax-efficient business structure that maximizes your financial success.

Section 6: IRS Audit Preparation

While it's always best to avoid audits by filing accurate tax returns, it's also important to be prepared in case you're ever audited by the IRS. This section provides a step-by-step guide to the audit process, from understanding your rights to responding to inquiries and supporting your claims.

By following the advice in this section, you'll be well-equipped to navigate an IRS audit with confidence and minimize your exposure to penalties and additional taxes.

"Powerful Ways To Maximize Your Income Tax Potential" is the ultimate resource for individuals and businesses seeking to maximize their tax savings and increase their financial prosperity. With its comprehensive strategies, practical advice, and invaluable insights, this book will empower you to navigate the tax code effectively and unlock your full income tax potential.

Don't let tax time be a stressful experience. Free Download your copy of "Powerful Ways To Maximize Your Income Tax Potential" today and start saving money on your taxes tomorrow.

4.9 out of 5

| Language | : | English |

| File size | : | 365 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 95 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Michael Elsohn Ross

Michael Elsohn Ross Mary Ann Hogan

Mary Ann Hogan Michael R Lindeburg

Michael R Lindeburg Michael Pillsbury

Michael Pillsbury Nainy Seth

Nainy Seth Meredith Badger

Meredith Badger Rory Fanning

Rory Fanning Stephen Rodrick

Stephen Rodrick Robert C Smith

Robert C Smith Paul Sterry

Paul Sterry Michael D Berdine

Michael D Berdine Sabrina Ching Yuen Luk

Sabrina Ching Yuen Luk Michael Covel

Michael Covel Mike Curato

Mike Curato Samantha Hahn

Samantha Hahn Caitlyn Dare

Caitlyn Dare Michael Sloan

Michael Sloan Roseanne Murphy

Roseanne Murphy Nate Hambrick

Nate Hambrick Mayim Bialik

Mayim Bialik

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Alexander BlairThe Ultimate Guide to Doom Eternal: Hacks, Tips, Gameplay Modes, and Download...

Alexander BlairThe Ultimate Guide to Doom Eternal: Hacks, Tips, Gameplay Modes, and Download... Octavio PazFollow ·2.2k

Octavio PazFollow ·2.2k Gerald BellFollow ·4.5k

Gerald BellFollow ·4.5k George MartinFollow ·9k

George MartinFollow ·9k Albert CamusFollow ·19.2k

Albert CamusFollow ·19.2k Brent FosterFollow ·15.9k

Brent FosterFollow ·15.9k Dylan MitchellFollow ·5.2k

Dylan MitchellFollow ·5.2k Gilbert CoxFollow ·13.6k

Gilbert CoxFollow ·13.6k Ernesto SabatoFollow ·10.1k

Ernesto SabatoFollow ·10.1k

Henry James

Henry JamesCold War Fighter Pilot Story: A Captivating Tale of...

Enter the Cockpit of...

Rudyard Kipling

Rudyard KiplingYour Body Your Baby Your Choices: The Essential Guide to...

Pregnancy and...

Fabian Mitchell

Fabian MitchellMichelle Obama: An Intimate Portrait - A Must-Read for...

Michelle Obama is a prominent figure in...

Juan Butler

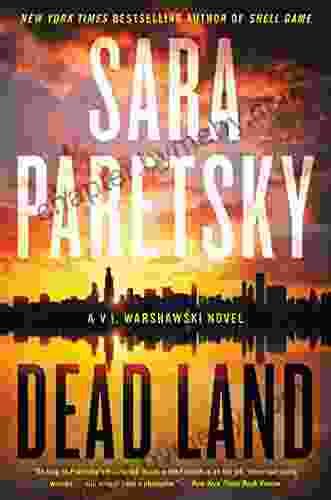

Juan ButlerUncover the Secrets of the Dead Land Warshawski Novels

Prepare to delve...

4.9 out of 5

| Language | : | English |

| File size | : | 365 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 95 pages |

| Lending | : | Enabled |